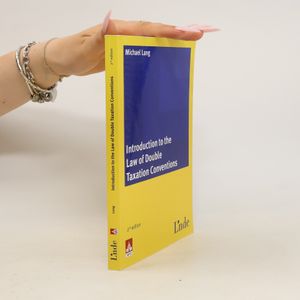

Más información sobre el libro

Cross-border activities or transactions may trigger tax liability in two or more jurisdictions. In order to mitigate the financial burden resulting from these situations, states have entered into numerous double taxation conventions, which provide for rules that allocate the taxing rights between the contracting states. This book provides an introduction to the law of double taxation conventions. Through examples from different countries and their jurisdictions, the book gives a global overview. The problem of double taxation, the state practice in the conclusion of double tax conventions and their effects, the interpretation of double taxation conventions and treaty abuse are also discussed in detail. Finally, the book analyses all provisions of the OECD and UN Model Tax Conventions on Income and on Capital and the OECD Model Convention on Estate, Inheritance and Gift Tax

Métodos de pago

Nadie lo ha calificado todavía.