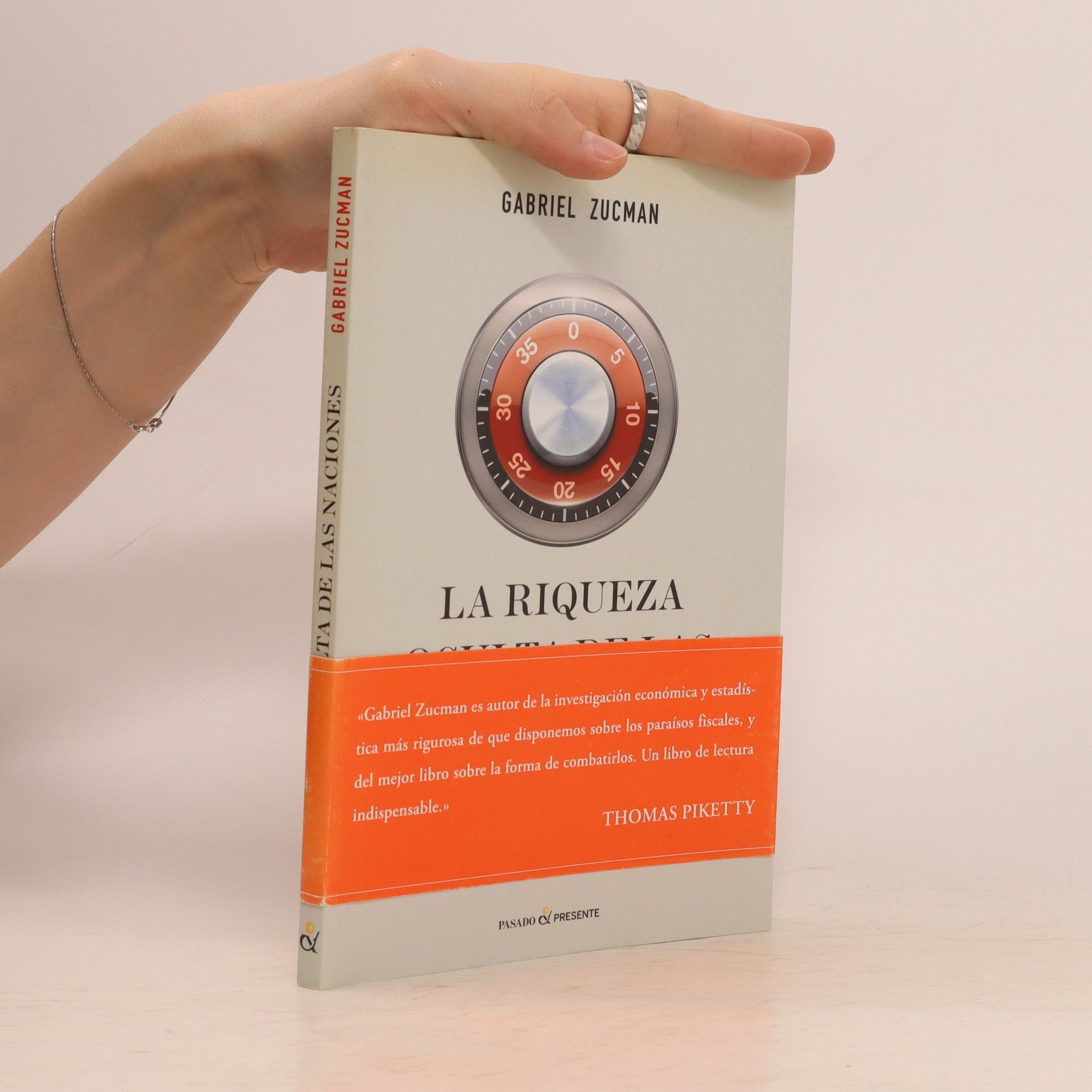

La riqueza oculta de las naciones. Investigación sobre los paraísos fiscales

- 168 páginas

- 6 horas de lectura

En los paraísos fiscales se oculta, como mínimo, la fabulosa cantidad de 6 billones de euros, que suponen un robo a los estados de unos 130.000 millones de euros en impuestos. En este libro directo y revelador, Gabriel Zucman rastrea todo ese dinero oculto y propone las vías de solución para acabar con este escándalo, con lo que se podría generar una prosperidad que los gobiernos declaran imposible y niegan a sus ciudadanos.