Valoración del libro

Más información sobre el libro

Wall Street faces a painful paradox: despite sophisticated investors, advanced technology, and extensive government oversight, it has become increasingly risky. Financial crashes and catastrophic losses are alarmingly frequent, with hedge funds often following a familiar pattern of failure. Today's crises stem not from economic instability or natural disasters, but from the very design of financial markets. Richard Bookstaber, a hedge fund expert, offers an insider’s view of the tumultuous decisions made by influential figures like Warren Buffett and Sandy Weill, as well as his own role in market disruptions. He created complex options and derivatives that, coupled with global market integration and rapid transactions, can lead to chaos. Bookstaber argues that the very innovations and regulations intended to stabilize the markets often exacerbate risks for all participants. He highlights vulnerabilities such as liquidity that fosters excessive leverage, innovations that increase complexity, and a market structure that requires unrealistic rationality. His proposed solutions—reducing complexity and loosening the tight coupling of transactions—challenge Wall Street's status quo but promise a more stable market environment.

Compra de libros

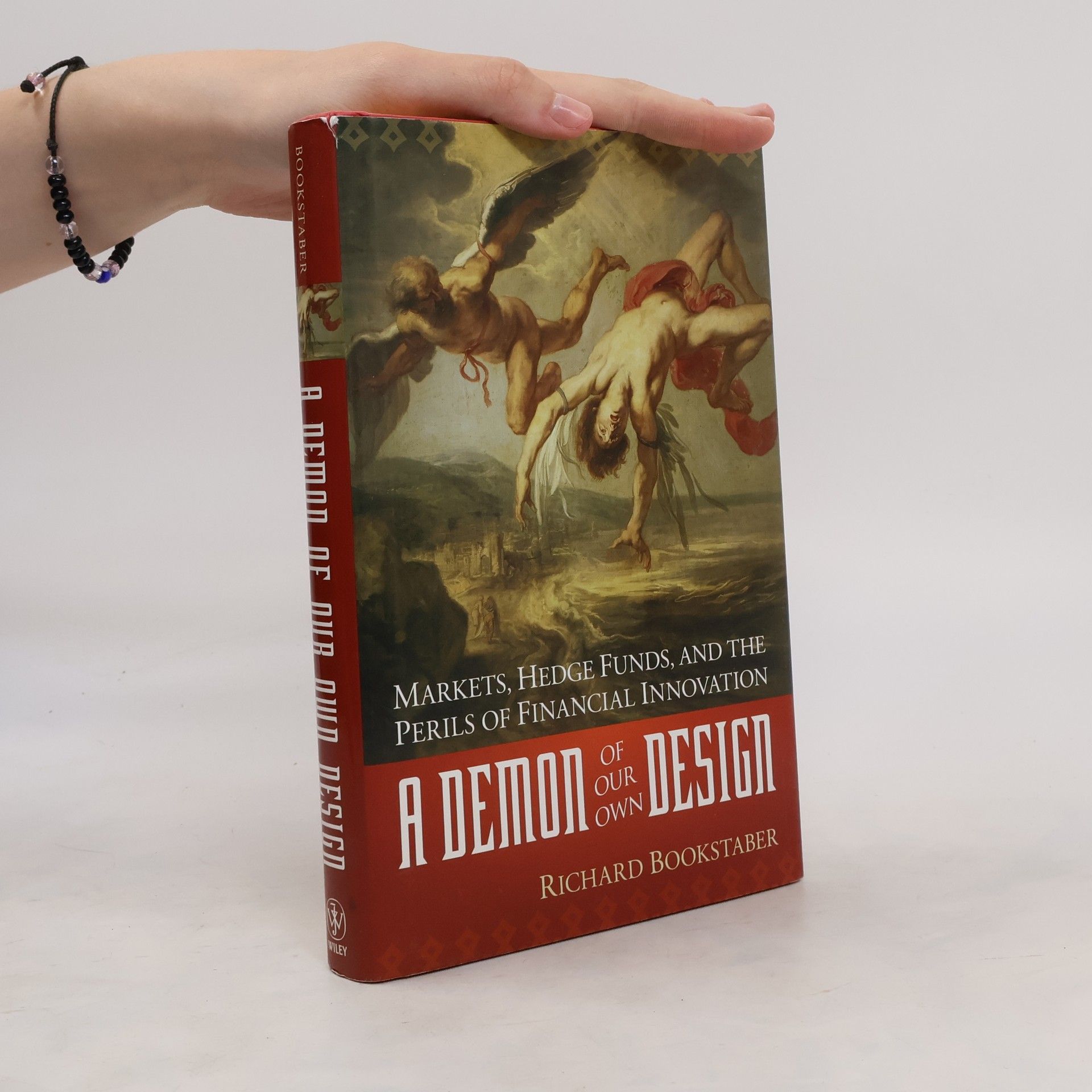

A Demon of Our Own Design, Richard Bookstaber

- Idioma

- Publicado en

- 2007

- product-detail.submit-box.info.binding

- (Tapa dura)

Métodos de pago

Nos falta tu reseña aquí