Parámetros

- 336 páginas

- 12 horas de lectura

Más información sobre el libro

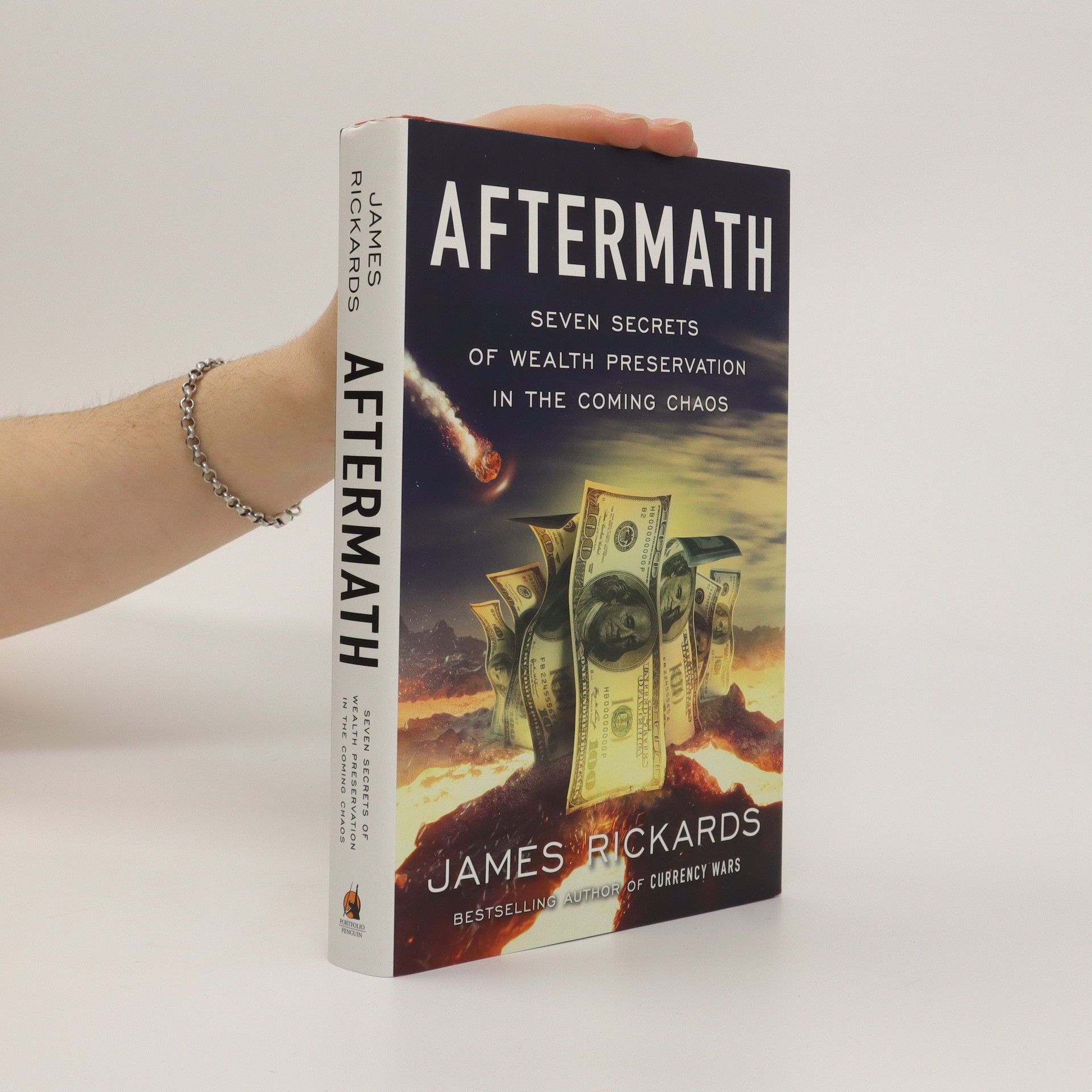

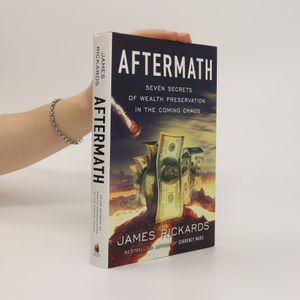

The past decade has shown that a significant financial crisis is imminent. While the American economy seems to have recovered from the 2008 recession, driven by tax cuts and investor optimism, history teaches us that stock market highs are unsustainable. Current conditions, including inflated asset prices, low interest rates, and the rise of index funds, mask underlying systemic risks such as market volatility, soaring debt, and political instability. In this insightful analysis, financial expert James Rickards outlines the impending economic turmoil and highlights which asset classes are most vulnerable. He advises against high-valuation tech and media stocks like Facebook, Netflix, and Amazon, and warns investors to avoid digital currencies such as Bitcoin and Ethereum. Rickards argues that passively managed index funds hinder market corrections, creating opportunities for active investors. He emphasizes that cash will remain essential when asset values plummet by 50% or more during a financial panic. Additionally, he critiques behavioral economists who influence 401(k) plans, leading investors to overexpose themselves in equity markets. With a no-nonsense approach reminiscent of his previous works, Rickards exposes the key players and capital flows shaping the global economy.

Compra de libros

Aftermath, James Rickards

- Idioma

- Publicado en

- 2019

- product-detail.submit-box.info.binding

- (Tapa dura)

Métodos de pago

Nos falta tu reseña aquí