Más información sobre el libro

Dynamic Hedging is an essential guide to managing derivatives risk, offering a practical approach for portfolios with nonlinear securities. It presents insights from the perspective of option market makers and arbitrage operators. Authored by an experienced trader with theoretical expertise, it adapts option theory to real-world scenarios, addressing the limitations of traditional mathematical models in capturing market exposure. Nassim Taleb explores both on-model and off-model derivatives risks, discussing critical concepts in accessible language. Key topics include the generalized option, which covers all convex payoff instruments, and trading techniques for exotic options like binary, barrier, multi-asset, and Asian options, while considering the complexities of actual distributions. The book examines market dynamics from a practitioner's viewpoint, addressing liquidity issues, portfolio insurance, volatility surfaces, and the shortcomings of value at risk methods. It introduces new risk detection tools, including higher moment analysis and nonparametric techniques, while emphasizing the path dependence of dynamically hedged options. Filled with practical tools, market anecdotes, and concise risk management rules, it also presents fundamental derivatives mathematics in intuitive terms, making it a valuable resource for practitioners.

Publicación

Compra de libros

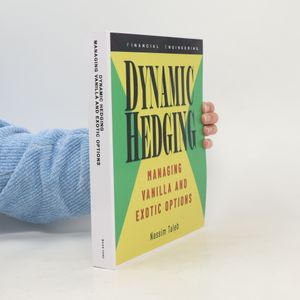

Dynamic Hedging, Nassim Nicholas Taleb

- Idioma

- Publicado en

- product-detail.submit-box.info.binding

- (Tapa blanda)

Métodos de pago

Nos falta tu reseña aquí